Insurance clearinghouses

An insurance clearinghouse as part of the claims submission process is essential in all healthcare fields. An insurance clearinghouse acts as intermediaries between healthcare providers and insurance payers, ensuring that claims are processed accurately and efficiently. This knowledge is crucial for therapists aiming to understand the billing processes, streamline it if possible, reduce claim denials, and ultimately enhance their revenue cycle management.

Summary

- An insurance clearinghouse serves as an intermediary between therapists and insurance payers, ensuring claims are properly formatted, accurate, and efficiently processed to minimize denials and delays.

- Using a clearinghouse can streamline the billing process by reducing errors, expediting payments, ensuring compliance with insurance regulations, and providing valuable insights through reporting and analytics.

- By leveraging clearinghouse services, or EHRs like TheraPlatform that are integrated with clearinghouse services, therapists can optimize their claims submission process, improve cash flow, and focus more on patient care rather than administrative tasks.

→ Click here to enroll in our free on-demand Insurance Billing for Therapists video course [Enroll Now]

The claims submission process in therapy practices involves several critical steps, from gathering patient information to receiving payments from insurance companies. This process can be intricate and fraught with potential pitfalls, such as errors in claim data, compliance issues, and challenges in communication with payers. An insurance clearinghouse is pivotal in navigating these complexities, acting as a bridge that connects therapists with insurance providers.

This guide strives to demystify the role of an insurance clearinghouse in the claims submission process. By providing a comprehensive overview of their functions and benefits, therapists will gain valuable insights into how these entities can help them optimize their billing processes, ensure compliance, and maximize revenue.

Streamline your insurance billing with One EHR

- Claim batching

- Auto claims

- Automated EOB & ERA

- Real-time claim validation

- Real-time claim tracking

- Aging and other reports

Understanding the claims submission process

Overview of the steps involved in submitting insurance claims: The claims submission process begins with gathering the necessary documentation and patient information. Next, therapists must format the claims according to insurance standards and regulations. The claims are then submitted to the insurance payers directly or through an insurance clearinghouse. Finally, the therapist monitors the status of the claims, addresses any issues or denials, and receives payment.

Importance of accuracy and compliance in claims submission: Accuracy and compliance are paramount in claims submission. Errors or omissions in claim data can lead to denials, payment delays, and potential legal issues. Ensuring that claims are accurate and compliant with insurance regulations helps therapists avoid these problems and provides a smoother revenue cycle.

Challenges and complexities therapists may encounter in the claims submission process: Therapists often face challenges such as keeping up with changing insurance regulations, managing claim denials, and ensuring data accuracy. These complexities can be overwhelming, particularly for smaller practices without dedicated billing staff. An insurance clearinghouse offers a solution by handling many of these tasks, reducing the burden on therapists.

Watch this video to learn common insurance billing struggles and solutions

→ Start My Free Trial

→ Start My Free Trial

What does a clearinghouse do during claims submission?

An insurance clearinghouse in healthcare billing is an entity that receives, reviews, and transmits insurance claims from healthcare providers to insurance payers. It acts as an intermediary, ensuring that claims are formatted correctly and contain the necessary information before they reach the insurance companies.

Functions performed by clearinghouses in claims submission

Clearinghouses perform several key functions, including:

- Claim scrubbing: Reviewing claims for errors and omissions before submission

- Claim editing: Making necessary corrections to ensure compliance with payer requirements

- Claim transmission: Transmitting claims to insurance payers

- Claim tracking: Monitoring the status of submitted claims

- Reporting: Providing detailed reports on claim status and trends

Benefits of using an insurance clearinghouse for therapy practices

Using an insurance clearinghouse offers numerous benefits for therapy practices, including:

- Increased efficiency: Automating many aspects of the claims submission process

- Reduced errors: Catching and correcting errors before claims reach the payer

- Faster payments: Streamlining the process to expedite payments

- Improved compliance: Ensuring that claims meet all regulatory requirements

- Better reporting: Offering insights into claim trends and revenue cycle management

Preparing claims for submission

- Gathering necessary documentation and patient information: The first step in preparing claims for submission is gathering all necessary documentation and patient information. This includes patient demographics, insurance details, and records of the services provided.

- Formatting claims according to insurance standards and regulations: Claims must be formatted according to the specific standards and regulations of the insurance payers. This involves using the correct codes for diagnoses and procedures, as well as adhering to payer-specific guidelines.

- Ensuring accuracy and completeness of claims data: Ensuring the accuracy and completeness of claims data is critical. Inaccurate or incomplete claims can lead to denials and delays in payment. Double-checking all information before submission helps mitigate these risks.

Transmitting claims to an insurance clearinghouse

- Uploading claims data to the insurance clearinghouse platform: Once the claims are prepared, they are uploaded to the insurance clearinghouse platform. This can typically be done through electronic data interchange (EDI) or a web-based portal provided by the clearinghouse.

- Transmitting claims electronically for processing: After uploading, the insurance clearinghouse transmits the claims electronically to the appropriate insurance payers, ensuring that claims are delivered quickly and efficiently.

- Securing data transmission to protect patient privacy and confidentiality: Protecting patient privacy and confidentiality is a top priority in healthcare. An insurance clearinghouse uses secure transmission methods, such as encryption, to protect patient data throughout the claims submission process.

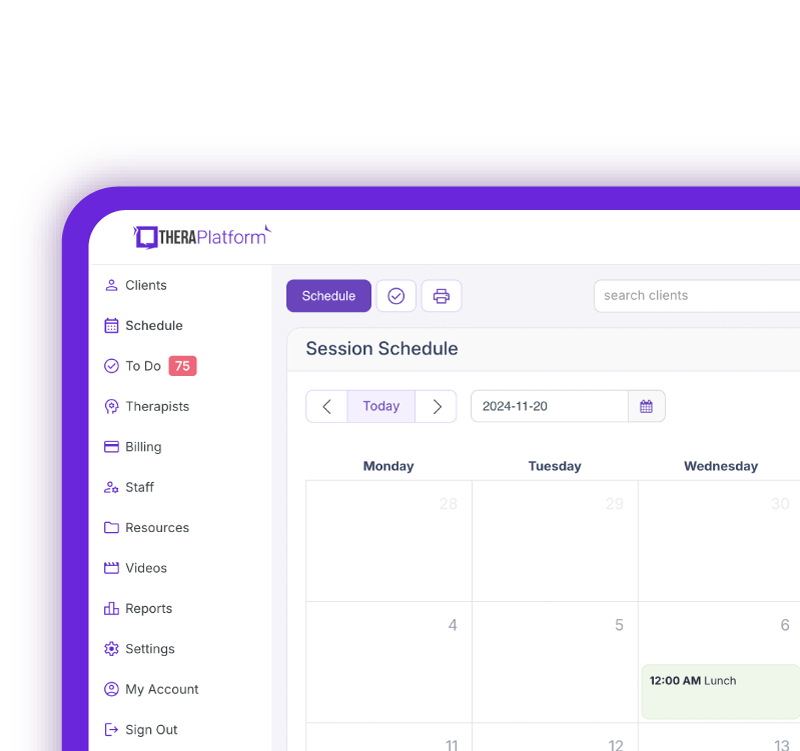

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

Scrubbing and editing claims

Reviewing claims for errors, discrepancies, and missing information

Insurance clearinghouses are important in minimizing claim denials by thoroughly reviewing each claim. This process, known as "claim scrubbing," involves examining claims for errors, discrepancies, or missing information that could disrupt successful reimbursement.

During this review, the insurance clearinghouse identifies issues such as mismatched or incomplete patient demographics, inaccurate provider information, and billing errors that could otherwise lead to claim rejection by payers. By intercepting these errors early on, an insurance clearinghouse helps providers maintain smoother workflows and improve cash flow.

Performing automated checks and edits to ensure claims accuracy

Clearinghouses leverage advanced automated tools that perform extensive checks to ensure claims accuracy. These automated processes can detect invalid CPT or ICD-10 codes, improperly formatted information, and non-compliance with payer-specific guidelines. For instance, payers may require specific coding or modifier use, which automated checks can verify before the claim is submitted. Automated editing systems are customizable to match a payer's unique requirements, ensuring each claim meets the necessary criteria. These edits provide an added layer of precision, saving valuable time and reducing the workload on staff, who would otherwise perform these tasks manually.

Correcting errors and resubmitting claims as needed

If errors are found during the scrubbing process, the insurance clearinghouse can correct these issues before the claim proceeds to the payer. Some insurance clearinghouses may automatically address minor corrections, while others may flag errors for manual review by the provider’s billing team.

This proactive approach improves claims accuracy and reduces the time needed to address rejections or denials after submission. Once corrections are made, the claim is resubmitted, ensuring compliance and increasing the likelihood of approval. By correcting errors upfront, an insurance clearinghouse can help therapy practices enhance revenue cycle management and prevent delays arising from denied claims.

Free Resources for Therapists

Click below and help yourself to peer-created resources:

Transmitting claims to payers

Forwarding clean claims to insurance payers for adjudication

Once the claims are thoroughly scrubbed and edited for accuracy, they are forwarded by the insurance clearinghouse to the respective insurance payers for adjudication. During adjudication, the payer evaluates the claim to determine coverage eligibility, medical necessity, and payment amount based on the policyholder’s benefits.

The payer reviews the claim details compared to their guidelines, including service codes, provider information, and contract-specific terms, to verify that the services align with coverage limits. This step is important as it directly impacts the reimbursement amount the therapist or practice will receive and determines any patient responsibility, such as co-pays or deductibles.

Tracking claims submission status and confirmation of receipt

An insurance clearinghouse provides a critical service by tracking the status of each submitted claim and confirming receipt from the payer, which enhances transparency in the claims process. By providing real-time updates on claims progress, they allow therapy practices to know precisely when a claim has been successfully transmitted and acknowledged by the payer.

This tracking feature keeps providers informed and allows for prompt follow-up if there are delays or errors in processing. Some clearinghouses offer detailed dashboards or reports that display claims statuses—whether pending, processed, or needing resubmission—enabling therapists to proactively address any bottlenecks in the claims cycle.

Watch this video to learn about denied claims

→ Watch the video

Managing rejected or denied claims and facilitating resubmission when necessary

In cases where a claim is rejected or denied, the insurance clearinghouse can play an essential role in managing the issue by identifying the reason for rejection and facilitating the resubmission process. A rejected claim often involves administrative errors, such as incorrect patient information, while a denial may result from policy exclusions or unmet coverage criteria. An insurance clearinghouse will analyze the payer's feedback to understand the reason for the issue and, when possible, make minor corrections or provide guidance on necessary adjustments for resubmission.

By quickly resolving these issues and ensuring compliance with payer guidelines, an insurance clearinghouse helps therapists secure reimbursements more efficiently and minimize revenue loss from avoidable denials.

Receiving and processing claim responses

Monitoring claim status updates and payment remittances

An insurance clearinghouse actively monitors claim status updates and payment remittances from insurance payers, ensuring that therapists are kept informed throughout the claims process. By tracking these updates, an insurance clearinghouse provides real-time visibility into each claim’s progress, from submission through adjudication to payment. This monitoring allows therapists to anticipate payment schedules and helps them quickly identify any delays or issues that may arise.

Tracking remittances—statements indicating how much of the claim was paid or adjusted—helps therapists reconcile payments and maintain an organized record of their revenue cycle.

Resolving claim rejections, denials, and payment discrepancies

When a claim faces rejection, denial, or payment discrepancies, the insurance clearinghouse resolves these issues efficiently. Rejected claims often stem from minor errors, like missing data fields, which the clearinghouse may correct directly or highlight for the therapist to address. In cases of denied claims, where coverage criteria may not have been met, the insurance clearinghouse assists therapists in understanding the specific reasons and, if applicable, supports appeals by submitting additional documentation or clarifying information as required by the payer. This proactive approach expedites the correction and resubmission process and reduces potential revenue delays.

Facilitating communication between therapists and payers as needed

An insurance clearinghouse acts as an intermediary between therapists and payers to streamline the claims process and ensure that issues are promptly addressed. When questions or disputes arise, the insurance clearinghouse can communicate directly with the payer on the therapist’s behalf, facilitating quick resolution and reducing administrative burdens for the therapist.

This role is particularly beneficial when additional information, such as treatment notes or further documentation, is needed for claim approval. By handling this communication, the insurance clearinghouse ensures that claims are processed more efficiently and that both parties remain informed and aligned throughout the process.

Providing reporting and analytics

Generating reports on claims submission and reimbursement trends: Clearinghouses generate detailed reports on claims submission and reimbursement trends. These reports provide valuable insights into the performance of the billing process and help identify areas for improvement.

Analyzing data to identify opportunities for process improvement: The data collected by the insurance clearinghouse can be analyzed to identify opportunities for process improvement. This can involve identifying common issues that lead to claim denials, optimizing claim submission practices, and enhancing overall revenue cycle management.

Leveraging insights to optimize claims submission and revenue cycle management: By leveraging the insurance clearinghouse's insights, therapists can optimize their claims submission process and improve their revenue cycle management. This can increase efficiency, reduce claim denials, and enhance revenue.

Clearinghouses aid therapists in the claims submission process. They handle many complexities in preparing, submitting, and managing claims, ensuring the process is efficient and compliant.

Leveraging clearinghouse services can help therapists streamline their billing processes, reduce errors, and maximize revenue. This leads to a more efficient and profitable practice that can focus on patient care rather than paperwork.

Therapists are encouraged to explore and utilize clearinghouse solutions to enhance their practice efficiency and profitability. By partnering with a clearinghouse or an EHR, like TheraPlatform with clearinghouse integration, therapists can focus more on providing patients quality care and less on billing and claims submission complexities.

How EHR and practice management software can save you time with insurance billing for therapists

EHRs, such as TheraPlatform, with integrated billing software and insurance clearinghouses, offer therapists significant advantages in creating an efficient insurance billing process. The key is minimizing the amount of time dedicated to developing, sending, and tracking medical claims through features such as automation and batching.

What are automation and batching?

- Automation refers to setting up software to perform tasks with limited human interaction.

- Batching or performing administrative tasks in blocks of time at once allows you to perform a task from a single entry point with less clicking.

Which billing and medical claim tasks can be automated and batched through billing software?

- Invoices: Create multiple invoices for multiple clients with a click or two of a button or set up auto-invoice creation, and the software will automatically create invoices for you at the preferred time. You can even have the system automatically send invoices to your clients.

- Credit card processing: Charge multiple clients with a click of a button or set up auto credit card billing, and the billing software will automatically charge the card (easier than swiping!)

- Email payment reminders: Never manually send another reminder email for payment again, or skip this altogether by enabling auto credit card charges.

- Automated claim creation and submission: Batch multiple claims with one button click or turn auto claim creation and submission on.

- Live claim validation: The system reviews each claim to catch any human errors before submission, saving you time and reducing rejected claims.

- Automated payment posting: Streamline posting procedures for paid medical claims with ERA. When insurance offers ERA, all their payments will post automatically on TheraPlatform's EHR.

- Tracking: Track payment and profits, including aging invoices, overdue invoices, transactions, billed services, service providers.

Utilizing billing software integrated with an EHR and practice management software can make storing and sharing billing and insurance easy and save providers time when it comes to insurance billing for therapists.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports mental and behavioral health, SLPs, OTs, and PTs in group and solo practices.

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Mental health credentialing

- Insurance billing 101

- Practice management tools

- Behavioral Health tools

Free video classes

- Free on-demand insurance billing for therapist course

- Free mini video lessons to enhance your private practice

- 9 Admin tasks to automate in your private practice

References

Alder, S. (2023, January 17). What is a Clearinghouse in Healthcare? HIPAA Journal. https://www.hipaajournal.com/clearinghouse-in-healthcare

Medical Claims Processing. (2024, October 23). American Medical Association. https://www.ama-assn.org/topics/medical-claims-processing

Electronic Billing & EDI Transactions | CMS. (n.d.). https://www.cms.gov, https://www.cms.gov/medicare/coding-billing/electronic-billing