Independent contractor vs. employee for group practice

Deciding whether to hire an independent contractor vs employee for a group therapy practice is an important decision for therapy owners with financial, operational, and legal implications.

Summary

- Independent contractors manage their taxes and benefits, while employers must handle payroll taxes, insurance, and legal compliance for employees. Misclassifying workers can lead to significant legal and financial consequences.

- Hiring employees comes with higher costs and administrative responsibilities, including benefits and HR management, whereas independent contractors reduce overhead but offer less control over their work.

- Employees provide consistency, team cohesion, and long-term client relationships, while independent contractors offer flexibility but may have inconsistent availability and integration challenges.

- Choosing between independent contractors and employees should align with a practice’s long-term goals, financial capacity, and operational needs, requiring a thorough cost-benefit analysis and compliance with state and federal regulations.

This guide will help you navigate the independent contractor vs employee decision by presenting a comprehensive overview of the benefits, challenges, and key factors to consider for each option.

Free Resources for Therapists

Click below and help yourself to peer-created resources:

What is the difference between an independent contractor vs employee?

Independent contractors provide services to an employer but are considered self-employed or entities, not employees. Independent contractors are not subject to the same regulations and employment laws as employees and often have greater control over their work.

Employees work under an employer's supervision and direct control, are part of the employer's workforce, and receive wages or a salary. The employer contributes to unemployment insurance and workers' compensation for employees.

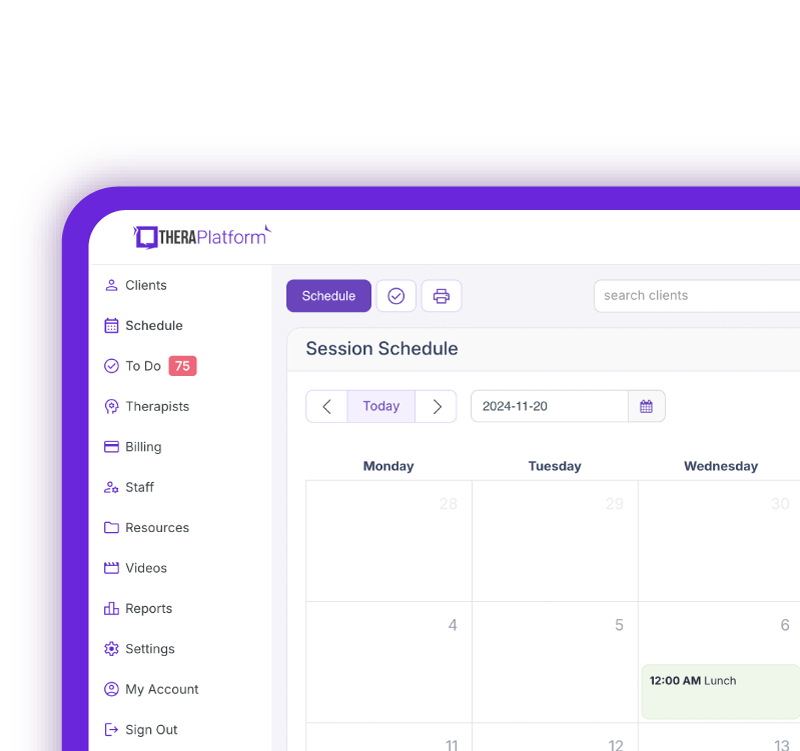

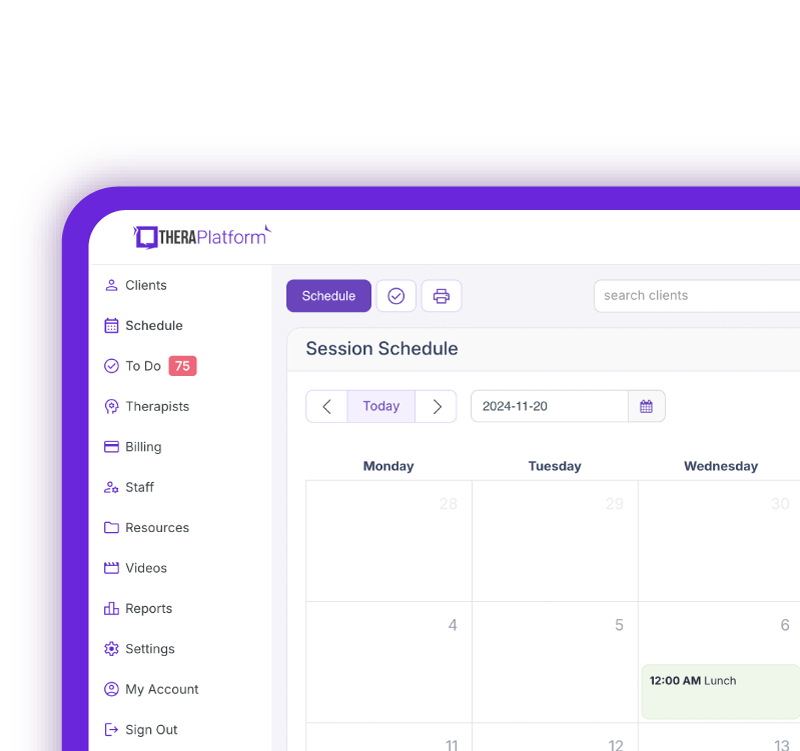

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Key legal and tax differences for independent contractor vs employee for group practices

The main legal and tax distinctions between an independent contractor vs. employee include:

- Employment taxes. Employers are typically responsible for paying employees' employment taxes (federal income tax, Social Security, Medicare). Independent contractors are not generally subject to these taxes, and they manage their taxes.

- Worker's compensation. Employees typically have worker's compensation insurance that the employer covers, while independent contractors do not.

- Benefits: Employers are generally required to provide health insurance, paid time off, retirement plans, and other benefits to employees. Independent contractors are not entitled to these benefits.

Benefits and challenges of hiring employees

Benefits

- Control and supervision: Hiring employees offers greater control over work processes and clinical practices. Managers can set guidelines and ensure that all staff follow the established standards and protocols.

- Consistency: Employees' work schedules generally have more consistent availability. This can help them steadily maintain service delivery and adhere to practice policies.

- Team cohesion: Building a cohesive team culture and collaboration with employees can be easier.

- Training and development: Therapy practices can invest in long-term training and professional development for employees. This can help advance their skills, contributing to the practice's growth.

- Client continuity: Employees may offer greater continuity of care for clients, as they are more likely to continue working at a practice long-term. This can ensure a more stable relationship with clients.

Challenges

- Higher costs: Increased costs related to salaries, benefits, payroll taxes, and insurance

- Administrative burden: More administrative tasks related to HR management and compliance

- Legal obligations: Compliance with employment laws and regulations (e.g., labor laws, workplace safety)

- Performance management: Need for ongoing performance evaluations and potential disciplinary actions

Benefits and challenges of hiring independent contractors in group therapy practice

Benefits

- Flexibility: Independent contractors offer greater flexibility in hiring and managing workloads based on demand.

- Cost Savings: Hiring independent contractors may result in lower overall costs, as there are no obligations for benefits, payroll taxes, or insurance.

- Reduced administrative burden: Fewer administrative tasks and legal obligations are associated compared to employees.

- Specialized skills: Practice owners can hire contractors with specialized skills for specific tasks or projects.

Challenges

- Limited control: A practice has less control over how independent contractors perform work. This can lead to inconsistencies in adherence to practice policies.

- Inconsistent availability: Varying levels of availability can lead to potential issues with the reliability and consistency of providing services.

- Team integration: Building a cohesive team and maintaining a consistent practice culture can be more challenging with independent contractors who may not fully integrate into the practice's environment.

- Client continuity: Potential disruptions in client care continuity can occur if contractors leave or change frequently.

- Legal risks: There are risks of misclassification and potential legal repercussions if contractors are deemed employees by authorities.

Legal and tax considerations for group therapy practice

The IRS provides specific criteria for classifying workers as independent contractors rather than employees. These criteria focus on control, finances, and the relationship between the employer and the individual. Employers can face significant penalties if misclassification occurs.

In addition to federal guidelines, it is important to understand and comply with state-specific regulations and policies governing worker classification.

Clear, legally sound contracts are critical when hiring independent contractors. These contracts can avoid disputes and ensure clarity by outlining payment terms, a description of job duties, and other key areas.

Practice owners should be aware of compliance risks. Misclassification can result in penalties, legal implications, and back taxes.

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

Financial implications

There are financial implications of hiring an independent contractor vs employee, such as salaries and tax responsibilities.

Completing a cost analysis of the independent contractor vs employee options can help practice owners compare the financial impact of hiring employees versus independent contractors. Consider the factors such as pay, benefits, payroll taxes, insurance, and contractor fees.

Consider assessing the practice's overall budget. Strive to balance the costs of salaries, benefits, and contractor fees with the practice's financial capacity.

A thorough understanding of the tax responsibilities is critical for financial planning and compliance. This includes considering the tax responsibilities and potential deductions for both classifications. Withholding applies to employees and self-employment taxes apply to independent contractors.

Operational considerations for group therapy practices

Assess the therapy practice's specific needs, including the consistency of care, flexibility, and degree of control required. Consider how each classification fits those needs.

Develop strategies for managing workloads and client care as an independent contractor vs. an employee. Consider how each classification can effectively contribute to your practice's operations.

Consider the practice's scalability with each option. Evaluate how hiring an independent contractor vs. an employee may impact your practice's operational flexibility and desired growth.

HR management and support for group therapy practices

Effective onboarding processes for new employees can seamlessly integrate them into the practice. Implementing a well-structured process can help new employees thoroughly understand their roles and responsibilities.

Administrators should also develop an efficient onboarding process for independent contractors involving clear communication of the expectations and details surrounding their job description.

Providing ongoing support and resources for employees and contractors ensures their success and allows any issues to be promptly addressed.

Decision-making framework for hiring

Use a clear decision-making framework to help you decide whether to hire employees or independent contractors for your therapy practice.

Assess practice goals. Align your decision with the practice's long-term goals. Consider factors like client care, operational efficiency, and growth.

Conduct a comprehensive analysis of each option's pros and cons. This can help you make an informed decision based on your practice's priorities and unique needs.

Gather input from key stakeholders within the practice, including current management and staff. Strive to ensure that the decision reflects consideration of the needs and perspectives of those closely involved in the practice.

Finally, make an informed decision based on the gathered data and analysis. The decision should consider the practice's immediate and long-term implications.

Implementation and transition action plan

Once you choose the appropriate model for the practice, develop a detailed action plan to implement it. Create timelines, communication strategies, and resource allocation.

Communicate the decision clearly to existing staff and stakeholders. Discuss the reasons behind the choice and how it will affect the practice.

Set up systems to monitor and evaluate the effectiveness of the model you've selected. Adjust over time as needed to keep your practice performing at an optimal level and maintain the satisfaction of your staff and clients.

Resources for hiring an independent contractor vs. employee

The decision to hire an independent contractor vs. an employee is significant and can significantly impact your therapy practice. By carefully considering key factors, such as the benefits and challenges of each option, legal and financial impacts, and your long-term goals, you can make an informed choice that will support your practice's success.

To further help you navigate this important decision of hiring an independent contractor vs employee, consider seeking professional guidance and utilizing available resources such as these:

- General Resources

- U.S. Department of Labor: Obtain guidance on employment laws such as the Fair Labor Standards Act (FLSA).

- State Labor Department: Consult your state's department for specific regulations outlined by its labor laws.

- IRS Publication 967: Provides detailed information regarding tax implications for hiring employees and independent contractors.

- Online Tools

- TheraPlatform: A practice management software with tools for scheduling appointments, billing, and electronic health records.

- Slack: Facilitates internal communication within your practice through direct messaging, file sharing, and integration with other apps.

- Trello: Offers visual tools such as task boards, lists, and cards to track practice goals, encourage team collaboration, and organize workflows.

- Consulting Services

- Tax advisors: A certified tax advisor can discuss the financial implications of hiring employees or independent contractors.

- Human resources consultants: Offers guidance for assessing your practice's needs, navigating employment laws, and developing hiring policies.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports mental and behavioral health, SLPs, OTs, and PTs in group and solo practices.

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Insurance billing 101

- Practice management tools

Free video classes

- Free on-demand insurance billing for therapist course

- Free mini video lessons to enhance your private practice

- 9 Admin tasks to automate in your private practice

References

Erlich, M. (2021). Misclassification in construction: The original gig economy. ILR Review, 74(5), 1202-1230. https://doi.org/10.1177/0019793920972321

Flinchbaugh, C., Zare, M., Chadwick, C., Li, P., & Essman, S. (2020). The influence of independent contractors on organizational effectiveness: A review. Human Resource Management Review, 30(2), 100681. DOI: https://doi.org/10.1016/j.hrmr.2019.01.002

Steingold, F. S., & Hotfelder, A. (2021). The employer's legal handbook: How to manage your employees & workplace. Nolo. DOI: https://books.google.com/books?hl=en&lr=&id=4UNIEAAAQBAJ&oi=fnd&pg=PP1&dq=private+practice+hiring+employees&ots=tf4lyKFl_w&sig=-06u-vLOCIrSn7PtWCRgyYb-Ceg#v=onepage&q&f=false