Bookkeeping for therapists

Bookkeeping for therapists is a skill taught to only a few. Therapists use their training to develop robust clinical expertise and provide quality care for their clients. Of course, several other components are required to run a successful therapy practice. One of the most critical aspects is strong financial management. That's where bookkeeping for therapists comes in.

→ Click here to enroll in our free on-demand Insurance Billing for Therapists video course [Enroll Now]

Summary

- Bookkeeping is essential for therapists – Proper financial management ensures tax compliance, business growth, and informed decision-making.

- Setting up a system – Choosing software like QuickBooks or TheraPlatform helps organize financial records and categorize income/expenses.

- Tracking income and expenses – Monitoring revenue sources (session fees, insurance, etc.) and expenses (rent, utilities, professional development) ensures financial stability.

- Managing cash flow – Budgeting, maintaining cash reserves, and using digital billing tools optimize cash flow and reduce financial stress.

- Tax compliance and reporting – Consulting a tax professional helps meet obligations and maximize deductions for practice-related expenses.

- Billing and payments – Automating invoicing and insurance claims streamlines the payment process and minimizes errors.

- Outsourcing and financial planning – Hiring a bookkeeper can improve efficiency, while setting financial goals supports practice growth.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Bookkeeping for therapists involves organizing, classifying, and maintaining a business's financial records. An efficient bookkeeping system can provide a backbone for sustainable growth and financial stability within a therapy practice.

Maintaining accurate financial records ensures tax compliance. The transparency of a bookkeeping system that accurately tracks income, expenses, and profits can also empower therapy practice owners to make informed financial decisions and help their practice thrive.

Let's walk through establishing and maintaining an efficient bookkeeping for therapists system to support your successful practice.

Setting up a bookkeeping system

Selecting software

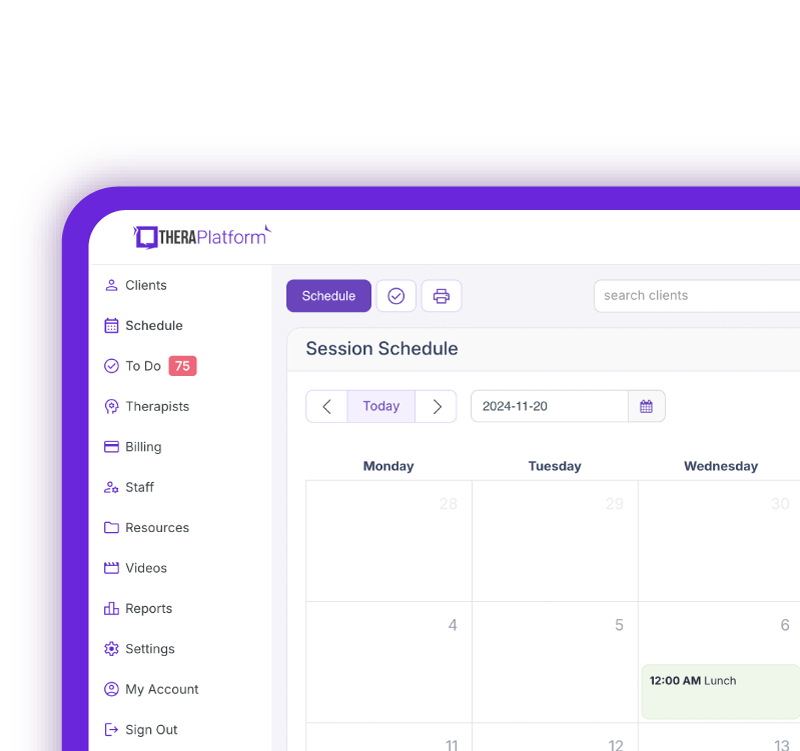

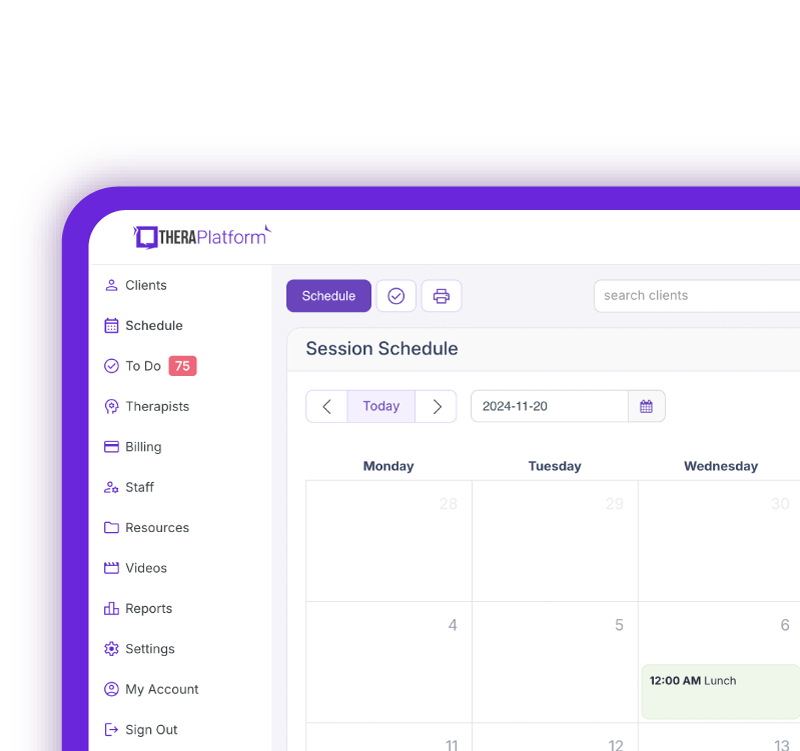

To set up your bookkeeping system, you must first select the right software or tools for your practice's needs. Platforms such as QuickBooks are user-friendly and offer unique solutions tailored specifically for healthcare professionals.

Practice owners should consider factors like ease of use, whether the software is cloud-based, and the availability of automated tasks such as generating reports.

Chart of accounts

A chart of accounts is a list of accounts that categorizes your income and expenses into distinct accounts. Establishing a chart of accounts tailored to therapy practice needs might include accounts for session fees, insurance reimbursements, rent, continuing education fees, marketing expenses, and office supplies.

Create a system

Therapy practices should develop a system for organizing receipts, invoices, and other financial documents. Practice management software such as TheraPlatform offers digital management systems that can systematically organize these documents to ensure that critical financial information is easily accessible, minimizing errors, maintaining compliance, and streamlining potential audits.

Tracking income and expenses

Therapy practices receive income from various sources. Diligently recording sources of income, including session fees, co-pays, insurance reimbursements, and other revenue streams (e.g., online programs or workshops), can provide therapists with insight into their revenue streams and identify growth opportunities.

Clinicians should monitor expenses through clear record-keeping and categorization in the chart of accounts. For therapy practices, this includes expenses such as rent, utilities, supplies, and professional development costs.

Tracking client payments and managing accounts receivable can ensure therapy practices promptly receive payment for services. Monitoring payments, including those executed with cash, checks, and credit cards, and implementing clear late-payment policies can add to the practice's financial stability. Practices can also utilize digital solutions that offer automated billing and payment reminders.

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

Managing cash flow

Budgeting and forecasting can help guide a therapy practice's financial future. Create a budget that takes into account income and expenses for a specific period to help plan for future costs, both expected and unexpected.

Maintain sufficient cash reserves to plan for the unexpected. This can help cover expenses like gaps in client payments or equipment needed to maintain business operations.

Practice owners can use strategies for optimizing cash flow, such as offering flexible payment options, creating easy, digital methods for streamlining the payment process, and following up promptly on overdue accounts.

To minimize the stress associated with the financial aspects of running a therapy practice, owners can consistently and diligently monitor the practice's finances and use digital tools.

Tax planning and compliance

Therapy practices must adhere to the required tax obligations. Therapists who are self-employed may file taxes as sole proprietors. Practice owners should consult a tax professional to understand their tax filing requirements.

Practice owners should explore potential deductions available to self-employed and small business therapists. Standard deductions such as rent, equipment costs, and professional development fees require meticulous tracking of business expenses.

Meeting with a financial planner and tax professional may give practice owners expert advice on different tax rates. Self-employed individuals may need to plan for taxes owed when filing to account for taxes that are not automatically deducted throughout the year as they are with those with an employer.

Complying with tax laws and regulations is essential to maintaining records, accurately reporting income and expenses, and timely filing of tax returns.

Financial reporting and analysis

Financial statements, such as profit and loss statements and balance sheets, can be generated to provide valuable insights into a therapy practice's financial health. Analyzing these reports over time can help therapists assess practice performance and identify areas for improvement.

Analyzing financial data allows practice owners to identify indicators like inefficiencies and opportunities for financial growth, helping them make data-driven, informed business decisions such as hiring additional staff, investing in areas like technology or additional training, and expanding services.

Managing client and insurance billing

A critical aspect of financial management within a therapy practice involves creating accurate invoices and promptly sending them to clients and insurance companies. Therapists can ensure this by utilizing software that streamlines the process through automated billing.

By tracking payments, therapists can identify discrepancies or errors. Prompt reconciliation of accounts receivable through manual or automated systems can ensure that these discrepancies are addressed.

Therapy practices can efficiently address billing errors and disputes by using digital software solutions (e.g., to double-check information such as coding for accuracy) and clear communication with clients and payers.

Outsourcing bookkeeping tasks

Therapists who want to focus on clinical practice but are overwhelmed by administrative tasks can consider outsourcing bookkeeping functions, which can be done by hiring a professional accountant or bookkeeper.

Selecting the right bookkeeping service provider is critical, and therapists may consider certified public accountants (CPAs) or virtual bookkeeping firms. Factors such as expertise, reliability, and compatibility with practice needs should be considered.

Outsourcing bookkeeping tasks offers benefits such as improved accuracy, efficiency, and cost savings associated with a practice's financial management. It can also allow therapists to focus on other areas of their practice. Potential drawbacks, such as security risks or costs associated with these services, should also be considered.

Free Resources for Therapists

Click below and help yourself to peer-created resources:

Financial planning and goal setting

Setting clear, achievable financial goals can support the stability and growth of a therapy practice. Specific and measurable goals should align with the practice's vision, including reducing expenses, increasing revenue, or expanding services.

Therapists can achieve financial goals by developing a budget and creating a financial plan. This plan might involve strategically allocating resources and considering marketing or staff training expenses.

Financial management includes ongoing monitoring of progress toward financial goals and allows therapists to identify areas for improvement and make adjustments as needed.

Legal and ethical considerations

Therapists must adhere to legal and ethical standards related to financial management, including HIPAA and professional guidelines.

Therapists can protect client confidentiality and sensitive financial information by utilizing secure data storage and training employees on processes for maintaining client trust and privacy.

Implementing certain policies and procedures can mitigate financial risks. Bookkeeping for therapists can include audits, verifying payment methods such as insurance coverage, and establishing protocols for late payments.

Summary

Effective bookkeeping for therapists is an essential component of a practice's success. A bookkeeping system can help therapists ensure tax compliance, organize information, and maintain records.

Solid financial management of a therapy practice includes:

- Setting up a bookkeeping system

- Tracking income and expenses

- Managing cash flow

- Adhering to tax regulations

- Managing client and insurance billing.

Prioritizing efficient bookkeeping for therapists processes to support the success and sustainability of their business.

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports mental and behavioral health, SLPs, OTs, and PTs in group and solo practices.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Insurance billing 101

- Practice management tools

Free video classes

- Free on-demand insurance billing for therapist course

- Free mini video lessons to enhance your private practice

- 9 Admin tasks to automate in your private practice

References

Adela, V., Agyei, S. K., Frimpong, S., Awisome, D. B., Bossman, A., Abosompim, R. O., ... & Ahmed, A. M. A. (2024). Bookkeeping practices and SME performance: The intervening role of owners' accounting skills. Heliyon, 10(1). DOI: https://www.cell.com/heliyon/pdf/S2405-8440(23)11119-4.pdf

Derricks, J. (2021). Overview of the Claims Submission, Medical Billing, and Revenue Cycle Management Processes. The Medical-Legal Aspects of Acute Care Medicine: A Resource for Clinicians, Administrators, and Risk Managers, 251-276. DOI: https://link.springer.com/chapter/10.1007/978-3-030-68570-6_11

Rezazade, F., Minutillo, S., & Patel, N. (2023). Accounting outsourcing and its relationship with financial performance of SMEs: Manager and employee perspectives. South African Journal of Accounting Research, 37(2), 106-121. DOI: https://doi.org/10.1080/10291954.2023.2172229